Dreaming of owning a slice of paradise in Dubai without breaking the bank? Jumeirah Village Circle (JVC for short) might just be the real estate answer to your prayers! This booming community combines the rare mix of affordable prices and high growth potential that smart investors love to see.

Picture a location where your investment can generate up to 9% annual rental yields—yes, you read that right!—while also giving you access to one of the most dynamic real estate markets in the world. Buckle up, we’re about to explore this hidden gem of Dubai that more and more French-speaking investors are discovering with great enthusiasm.

Do those numbers sound too good to be true? And yet! Few areas in Dubai offer such a balance between what you pay and what you get. It’s like finding a Michelin-starred restaurant with bistro prices—rare and precious! Let’s dive into the details that make Jumeirah Village Circle such a sought-after residential community.

Fifteen years ago, Jumeirah Village was just a patch of desert. Today? It’s a thriving residential area laid out like the spokes of a wheel! Designed by Nakheel Properties, this development has a unique circular shape—imagine a giant cheese wheel with a central park and radiating avenues. It’s not just pretty on a master plan; it fosters a true village vibe in the middle of a global city.

Every year, JVC evolves, grows, and greens. What started as a bold concept on paper is now one of Dubai’s most vibrant residential communities. One might say JVC is rising as fast as Dubai’s skyscrapers—and that’s saying something!

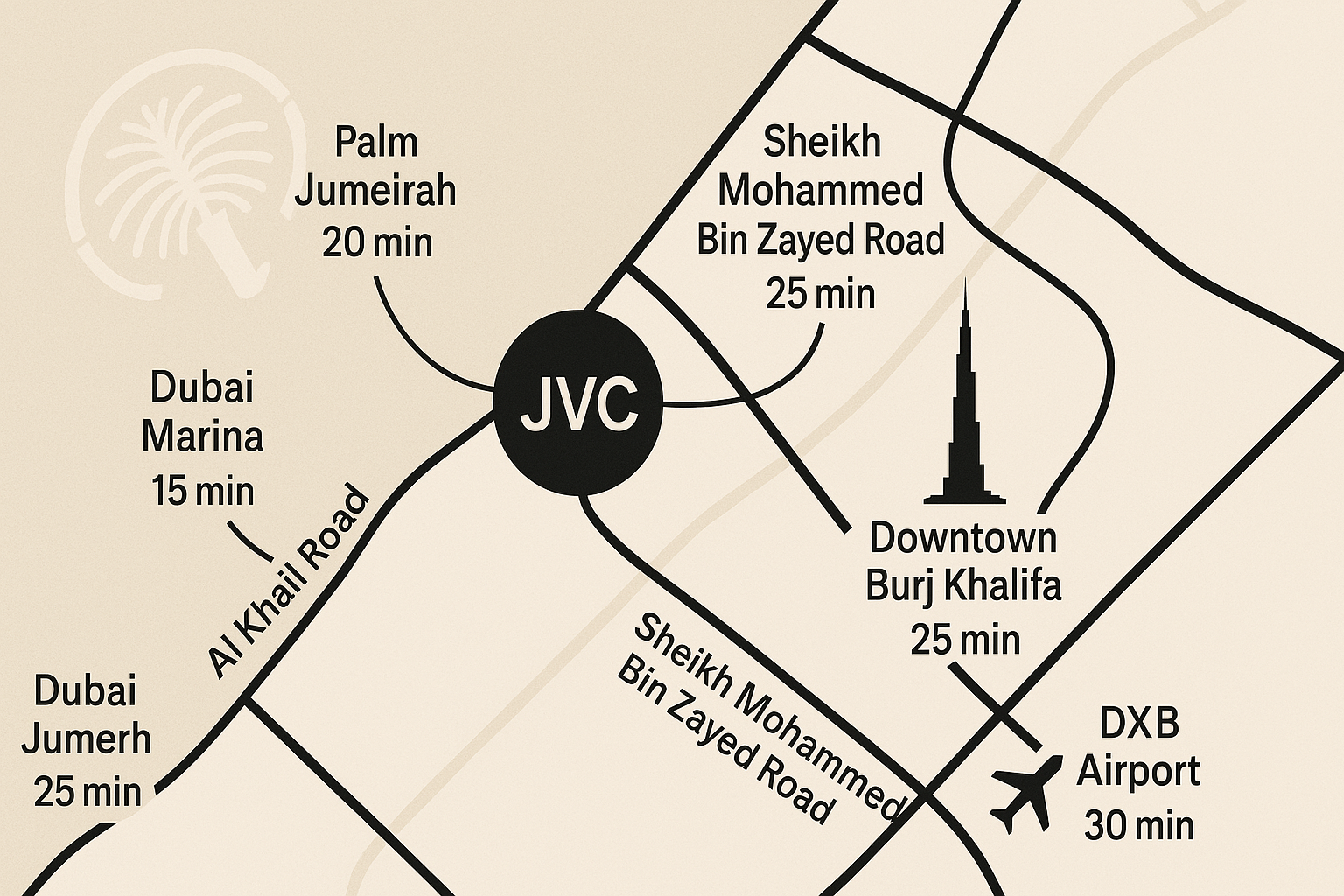

You’ve heard the saying “location is everything,” right? Well, JVC’s strategic location is one of its top strengths. Nestled between two major highways, this area puts you in the middle of the action while sparing you the tourist mobs and sky-high prices.

Its strategic location makes JVC the perfect base to explore the entire city. You’re close enough to everything without paying the premium of ultra-central areas. While cars remain the preferred mode of transportation (it’s Dubai, after all!), multiple bus lines serve the village circle. And the buzz that’s exciting investors? Upcoming metro extensions that could boost prices faster than an elevator in the Burj Khalifa!

If Dubai’s real estate market were a racetrack, JVC would be that underdog car quietly overtaking the favorites! Over the past two years, prices have risen faster here than the city average. The secret? Accessible entry points attracting a new wave of investors and homeowners.

A fascinating trend is emerging: while luxury districts have plateaued, JVC keeps climbing, powered by local and international demand. It’s like investing in Berlin’s trendiest neighborhoods a decade ago—those who took the leap rarely regretted it.

One of JVC’s key assets? There’s something for everyone! From compact studios to large villas, every property type appeals to different investors and residents:

| Property Type | Average Price (AED) | Average Price (EUR) | Gross Rental Yield |

|---|---|---|---|

| Studio | 400,000 – 550,000 | 100,000 – 137,500 | 8–9% |

| 1 Bedroom | 550,000 – 750,000 | 137,500 – 187,500 | 7–8% |

| 2 Bedrooms | 800,000 – 1,200,000 | 200,000 – 300,000 | 6.5–7.5% |

| 3 Bedrooms | 1,200,000 – 1,800,000 | 300,000 – 450,000 | 6–7% |

| Townhouse/Villa | 1,800,000 – 3,500,000 | 450,000 – 875,000 | 5.5–6.5% |

Let’s talk numbers—and they’re compelling! For the price of a studio in Paris, you can buy a spacious two-bedroom in Jumeirah Village Circle. Prices here are 60–70% lower than in Dubai Marina for similar properties, and half the cost of Downtown Dubai. As for rental yields… would you be happy with a return twice the European average? That’s exactly what JVC offers, making it a hotbed for savvy investors.

If JVC were a dish, it would be one of those well-kept chef secrets! This community combines several key ingredients that make it a recipe for success among discerning investors. Let’s look at what’s simmering beneath the surface of this rising real estate star.

Let’s face it, budget matters. In Jumeirah Village Circle, you simply get more for your money. For example: with AED 750,000 (~€187,500), you might only afford a studio in Downtown Dubai. But in JVC, that same amount gets you a spacious one-bedroom apartment—possibly with a beautiful terrace.

Don’t think affordability means compromising on quality. Many recent buildings feature high-end amenities like infinity pools, state-of-the-art gyms, and co-working spaces. It’s luxury living without the luxury price tag!

For first-time investors or those seeking diversification, investing in JVC is like getting VIP access without the premium price.

Unlike some “emerging” residential areas that leave you living in a construction zone for years, JVC already has its essentials in place. The area has reached that critical mass where daily living becomes genuinely comfortable:

The real charm of a residential community lies in its people. Jumeirah Village Circle has attracted a colorful mix of expats from all over the world. On a single park stroll, you might hear French, English, Arabic, and Hindi. This diversity adds a warm, cosmopolitan touch—perfectly reflecting Dubai’s global spirit without the flashiness of touristy districts.

If real estate were a marathon, JVC would be that runner with quiet endurance and plenty of gas left for the final sprint! Several factors point to strong future value appreciation:

Think back to areas like The Greens or JLT ten years ago. Early investors there saw their investments double or triple. Jumeirah Village Circle seems poised for a similar trajectory, with 5–8% annual appreciation forecasted. It’s like planting a tree at the right time—it only grows from here!

Even the prettiest picture has shadows, right? Despite all its perks, investing in JVC does come with some cautionary notes. So before booking that flight to Dubai, checkbook in hand, let’s explore what to look out for.

For international investors—especially French speakers—these nuances may feel overwhelming. Like trying to understand cricket when you grew up with football! Relying on trusted local advisors can make all the difference.

Tempted to jump into the JVC adventure? Fantastic! Let’s break it down step-by-step—consider this your GPS through the sometimes-chaotic world of Dubai real estate.

Budget for extra costs like:

Here’s the cherry on top for international investors: Dubai has no annual property tax and no capital gains tax upon resale. Imagine it—no tax eating your rental income, no cut when you sell. For those used to European tax systems, it’s like eating chocolate without gaining weight—hard to believe, but 100% true!

Contrary to popular belief, not everything in Dubai is paid for in cash. Here are your financing routes:

So, is Jumeirah Village Circle the next big thing in Dubai’s real estate market? The numbers and trends say yes! The area delivers that rare mix of affordability, strong rental returns, and appreciation potential that makes investors light up.

As with any investment, caution is key. Choose your property carefully, understand the full cost picture, and ideally work with seasoned professionals. It’s like cooking a complex dish—following a tested recipe boosts your chances of success!

For those willing to step off the beaten real estate path, Jumeirah Village Circle presents a rare opportunity where security, return, and development align. In a world where that combo is increasingly rare, this little circle in Dubai might just be the golden ticket you’ve been looking for. Ready to take the leap?

We Are Human

Abdelilah & Fatima

One Central, World Trade Center

Dubai - United Arabian Emirates

Licence N°1158170

ALIOKI

Monsieur Charles

Siret N°981 959 968 00018

20 place de la Petite Rigaudie

24200 SARLAT-LA-CANEDA

monsieurcharles@alioki.fr

OVH

Siret N°424 761 419 00045

2 rue Kellermann

59100 ROUBAIX

ovhcloud.com